Recent deals have the potential to upend the global TV rights market for premium sport. Ross Biddiscombe investigates.

Recent events in the sports rights industry will both reinvigorate and reset the battle for live TV sport in the UK and beyond.

The 50:50 joint venture between BT and Warner Bros Discovery (WBD), agreed in May, will have ramifications for all the major rights holders. These include the dominant live sports broadcaster, Sky, which continues to have its own sports partnerships with WBD.

BT’s deal with WBD also has implications for Amazon and other digital platform behemoths that are poised to increase their live sports content.

On top of this, in June, the sale of Indian Premier League (IPL) cricket rights broke a 20-year-old pattern for such auctions. Some matches were sold “exclusively” to two different domestic bidders – one broadcasting terrestrially and the other digitally. Analysts now wonder if this style of rights selling could become a worldwide trend.

The operational merger of BT Sport with WBD’s Eurosport will, for the time being, maintain the existing brands and customer offerings. The telco, having spent an estimated £890m on sports rights in 2021 alone, and having cemented its position as the UK’s number one broadband provider by using live sport as bait, must now find ways to work with WBD, which will take on the day-to-day running of the joint venture.

With UK sports fans increasingly happy to watch their favourite sport on streaming services, the ground is shifting in the traditional UK pay-TV business. Specialist sports apps are readily available, but a central question is whether or not the cost of UK live sports rights will rise again.

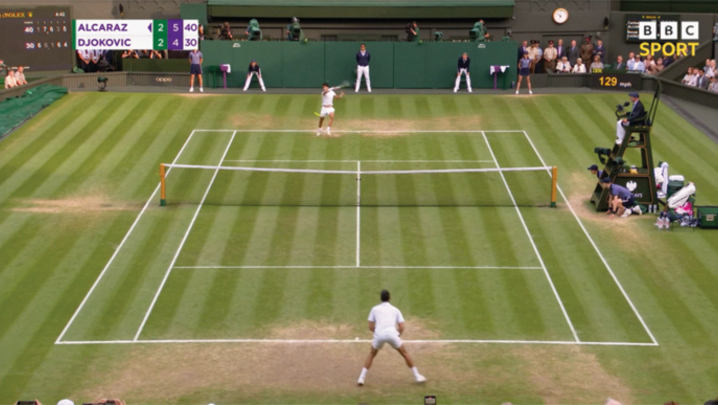

(Credit: Eurosport)

While Mike Darcey, media consultant and former chief operating officer at Sky, believes the newly merged operator will make bidding for rights such as the English Premier League trickier, there is potential to bring down costs.

“Going for more rights will be complicated with the joint venture in place, because BT will not want to fund such a move, and it will be difficult for WBD to pursue this unilaterally,” he says. “If WBD ever exercises its buyout [option] on the joint venture, then perhaps [we could see] a further push. The question is: how strong does WBD thinks its sports offering needs to be to fulfil its broader strategic objective?”

Tim Westcott, senior principal analyst for digital content and channels at Omdia, believes that, with WBD at the helm, BT’s “loss leader” approach to new broadband subscribers is unlikely to continue. He notes: “BT reported an operating loss of £287m in the last financial year. Despite long-term carriage agreements with BT and Sky, the new owners may need to curb sports rights costs to bring the joint venture into profit.”

It has been clear since last spring that BT has wanted to focus on its £12bn rollout of full-fibre broadband and on a new 5G mobile network, but questions around content remain because its contracts for the Premier League and European football run until 2025 and 2024, respectively.

Jack Genovese, research manager for sports at Ampere Analysis, believes any changes in the sports rights market will probably be slow to emerge: “All major sports rights are currently locked into pre-existing deals in the UK until 2024. The lack of tier-one sports rights in WBD/Eurosport’s portfolio [with the exception of the Paris Olympics in 2024] suggests that the impact on subscriptions is going to be relatively contained.”

Ampere estimates that Discovery represented only about 1% of the total spend on sports rights in the UK in 2021; BT accounted for about 25%; while Sky’s market share amounted to 54%, or £1.9bn. Genovese says: “Eurosport’s rights portfolio, which boasts popular events such as the next Olympics, will complement BT Sport’s existing rights portfolio.”

From WBD’s perspective, the driver for the joint venture is to accelerate the growth of Discovery+. Ampere’s survey of UK sports fans last year showed that only 9% subscribe to Discovery+, whereas 33% have BT Sport.

Sky has to deal with the threat of a new challenger while controlling its own sports rights spending. At one time, it looked as if sports streamer DAZN would become BT’s partner – but the streamer eventually pulled out.

Unlike DAZN, both WBD and Sky have a commitment to programming other than sports as subscription drivers. Darcey says that, although Sky – which pays £6m for every live Premier League match – has massively upped its investment in original shows, it is not a case of “either or”. “Sport is still very important to Sky and it will want to remain the clear number-one sports bundle.” The question is, he says: “How much sport is needed to sustain this position?

“Sky has already scaled back and let many properties go elsewhere. This shows it is willing to walk away if prices get too silly. But if it thinks it can maintain that position at lower cost, then it will try to do so.”

Omdia’s Westcott points out that Sky in Italy and Canal+ in France have already faced up to the loss of league football “without suffering too much”. Moreover, WBD President and CEO, David Zaslav, has a track record of not paying over the odds for content of any kind.

Managers at Sky have raised the possibility of a Sky minus premium sport. Most recently, Sky Sports Managing Director, Jonathan Licht, has said that the loss of EPL rights would be “upsetting” but that the business was no longer reliant on any one property.

The other looming questions about UK sports rights involve the future strategies of the big tech platforms, as well as those of legacy media players such as Disney and Paramount (Viacom). Commentators are still uncertain about whether Amazon will press further into sports, whether Disney will try to replicate its ESPN-type tactics beyond the US, and what role Apple and Netflix might play in sports rights.

Darcey says it is not clear whether sport will become part of the broader battleground between the SVoDs. “But it seems a bit parochial to think that, if this is happening, we will see it first here in the UK, triggered by a local joint venture, as opposed to it starting in the US or somewhere else in the world,” he says.

Indeed, the way the IPL cricket rights were diced for the 2023-27 cycle could be the most telling. With $6.2bn being paid for 410 IPL games over the next five years, cricket became the world’s second-most-expensive TV sport – but what was more shocking was that the Indian domestic deals broke the tacit agreement over exclusivity.

Darcey explains: “The IPL has done precisely what the Premier League shied away from in 2000 (and ever since), and what regulators have consistently been too scared to impose – it sold ‘broadcast’ and ‘digital’ rights to the same set of matches, in the same territory, to two separate pay providers.”

It remains to be seen whether other rights holders, such as the Premier League, can sell “double exclusive” matches in the UK or other countries.

The day after the IPL announcement, Apple stumped up a reported $2.5bn for Major League Soccer in the US. An executive involved in the bids for IPL told the Financial Times: “Sports rights are a very strange beast, it seems, because nothing seems to stop their march. People don’t want to be left out and the fact is, people consume sport regardless [of the economic climate].”

Shortly before Television went to press, Amazon secured the UK rights – split with existing holder BT Sport – to broadcast live Champions League football from 2024 to 2027. With Europe’s premier club championship expanding, BT will, in fact, show more matches live. Amazon will have first pick of Tuesday-night games. The deal also sees highlights return to terrestrial TV on a midweek BBC Match of the Day show. Amazon already holds the UK rights to 20 Premier League matches a season.

Initially, BT Sport and Discovery subscribers are set to receive BT Sport and Discovery+. Subsequently, a single, newly branded streaming sports service will launch with a huge range of top events.

Westcott believes that football remains key to the future of UK sports broadcasting. While the market for pay-TV sports subscriptions has plateaued, it is still the case that 10 million UK households are prepared to spend £20 a month for premium sport.

“If operators choose not to invest as much to secure the rights to support that business, the option for rights holders to go it alone is much more viable than it was in 2013,” says Westcott. “The next Premier League rights auction will determine in which direction the market goes.”

Additional reporting by Kate Bulkley.