In a rapidly shifting landscape of television viewing, our panel of experts got to grips with today’s reality

Once upon a time, measuring TV was straightforward. Channel controllers and production heads would wait anxiously for the overnight viewing figures to land on their desks. Ratings would be assessed on a single broadcast transmission. The overnights could determine a show’s fate – and sometimes the jobs of those who had commissioned it.

Multi-channel TV complicated the picture, but the arrival of catch-up, then streaming and platforms such as YouTube and TikTok really upset the applecart on collecting and analysing the vital data pored over by ad agencies and their clients.

Last month, a packed RTS event tackled the complexity of understanding TV audiences in a multi-platform, online age. To get us started, US media cartographer Evan Shapiro, no stranger to speaking at RTS conferences, presented via video a report he has collaborated on with UK audience measurement body, Barb. “A wave of change” was coming to the UK TV and video universe, driven primarily by changing demographics, said the eloquent number-cruncher.

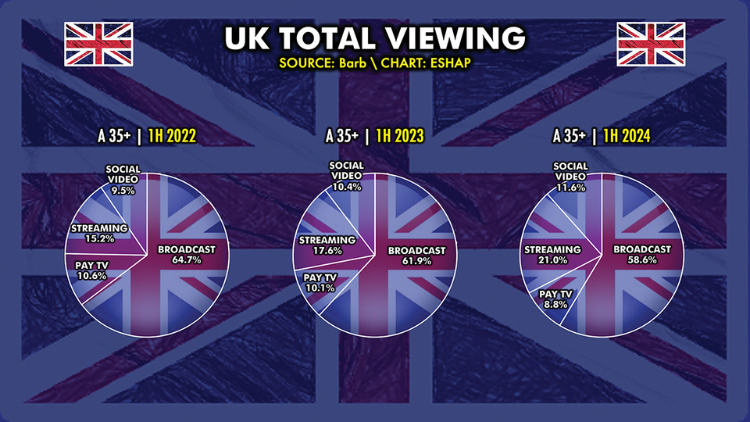

Older viewers still dominated TV audiences, but this would change. When today’s under-40s became the over-55s, they would take their viewing habits with them, he predicted. And this posed a huge risk for the BBC and the UK’s commercial PSBs unless they adapted quickly.

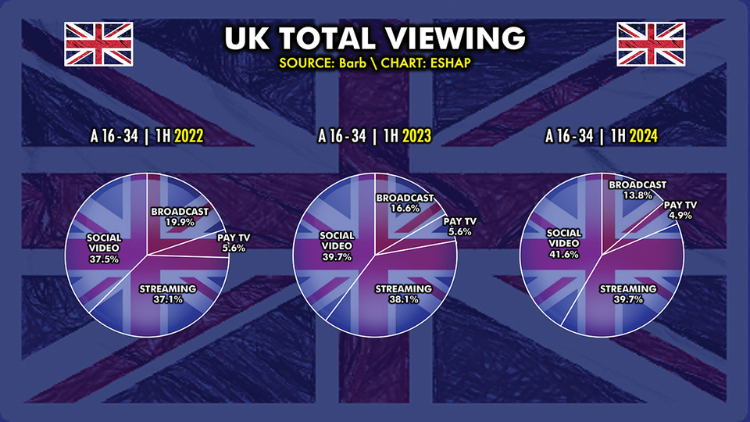

Streaming was on the rise across all age groups, said Shapiro, and growing fastest among older audiences, with a simultaneous drop in the popularity of broadcast and pay TV, even among over-35s. “One of the biggest stories in the data [is this]: YouTube is now the second largest video platform in the UK, after only the BBC. And, with audiences over 35, the ‘Social Video’ platform now ranks third, ahead of Channel 4, Channel 5 and Sky.” Shapiro continued: “For that reason, to understand the competition correctly, the UK (and global) television industry must now consider YouTube as a TV channel.

“With millennials and gen Z, YouTube and TikTok now rank first and third, bookending Netflix, and beating all broadcasters and pay TV providers. In the first half of 2024, for all audiences under 35, YouTube pulled in more watch time than all the broadcasters combined.”

No wonder those Google executives sleep soundly at night.

There was, however, an opportunity for the PSBs and pay-TV players, said Shapiro, to collaborate with YouTube as a distribution partner and TikTok as a marketer. Just as the early launch of BBC iPlayer (on Christmas Day 2007) was key to growing streaming in the UK, the new PSB-backed streaming service, Freely, should help strengthen the traditional British broadcasters’ defences against the US streamers.

Unless they adapt to the changes, driven by demographics, there will be a mass migration from their platforms to paid and free streaming and social video, predicted Shapiro.

What did the panel make of all this, asked the session chair, journalist John Moulding. Neil Mortensen, Director of ITV Insights Group, formed last year when ITV merged its data and research teams, told the RTS he was confident that audiences were being measured accurately, despite the increased complexity of viewing choices. “Barb has evolved brilliantly and consistently over the last few years,” he said, referring to its innovative cross-platform measurement system. “[But] in the future, it’s going to get more and more difficult.”

Lucy Gregory, Vice-President, Audience Measurement & Insight at The Walt Disney Company, noted that defining “TV viewing” was complicated in the contemporary market. It embraced linear channels, of which Disney still ran more than 150 across Europe, in parallel with streaming services such as Disney+. “According to Barb, linear, BVoD and SVoD are consumed 90% on the TV set,” she said. “For Disney+, 50% of our 16-plus adult audience is under 35. We have a significantly young-skewing platform.”

From an advertisers’ perspective, does it matter where the audience is? Amy Tocock, Head of Planning at media agency PHD, said it does. “Like viewers, advertisers don’t all behave the same way. They have a vast spectrum of needs. For some, it’s low-cost eyeballs. At the other end of the scale, it’s advertisers who are super-keen to be in very specific content.”

Mortensen again stressed the excellence of Barb’s measurement system. In the last 10 years, the UK had gone from TV sets-only measurement to all devices, and the ability to measure broadcasters, streamers, 28-day catch-up et al. “The list goes on,” he said. “They are giant steps forward.”

Gregory said Disney+ was the first streamer to sign up to Barb in November 2021, a move that led to “massive transparency over what the streamers were doing.” Other big streamers feared missing out, and came on board Barb. “We’re now on another journey with our Disney+ ad tier,” she said.

Tocock said that when planning an advertising campaign, audiences had to be looked at “holistically”. Yes, Barb was a gold standard, but PHD had created its own tools to dive deeper into viewing data. “All the channels have a very different profile and are bringing something different to the table,” she said. “There isn’t a great deal of overlap between a YouTube viewer and [one on] BVoD linear.

“We need [audience] understanding to be able to go back to our clients and help prove to them that every pound invested is a pound well spent. There is more and more pressure on them to ensure that’s the case.”

From a production perspective, cross-platform measurement was hugely important to ITV Studios for licensing or winning re-orders for the shows it produces. “It’s a huge advance for us,” said Mortensen. “Were it not for Barb’s measurement, we’d have no idea how Rivals (made by ITV Studios for Disney+) had done. Obviously, Studios would want to get a recommission.

“Some streamers would change how they measured a show or would only give us some of the information. It was bamboozling and a one-sided argument. Now everyone has equal access to the data.”

Turning to Shapiro’s point that YouTube should now be regarded as a huge broadcasting platform, Gregory downplayed YouTube’s value as a distribution platform. It was “a touchpoint for Disney” but the main priority was to build Disney+.

Tocock said that while YouTube delivered cost-effective reach, there were many layers within that. It was important to ensure there were “guard rails,” so that the platform provided a safe environment for advertisers.

Finally, did the panel agree with Shapiro that the viewing habits of younger audiences wouldn’t change as they got older? Tocock said she didn’t know what tech was around the corner, but because we are social animals she was optimistic that in 10 years’ time people would still be watching great shows together on TV sets in their living rooms. Mortensen thought that, in future, YouTube might be the way into the TV set, but he’d be disappointed if – when his teenage sons are middle-aged men – they watched content in solitude on their phones.

‘Tick-tock: has time run out on TV measurement?’ was an RTS National Event held on 29 October at the Cavendish Conference Centre, London. The producer was Victoria Fairclough.