Mathew Horsman analyses the impact of Comcast’s recent £30bn purchase of the European pay-TV platform

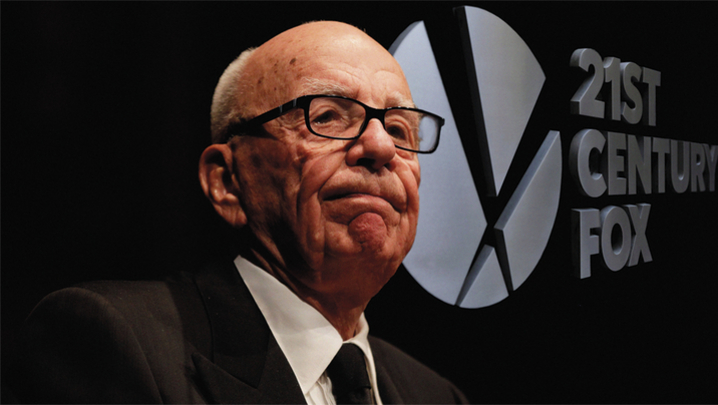

It’s official. Sky, the leading pay-TV platform in the UK, is no longer a Murdoch company. The man most closely identified with the launch and development of the film and footie satellite giant, Rupert Murdoch, signalled his departure late last year, when his 21st Century Fox media behemoth agreed to sell most of its pay-TV and Hollywood studio assets, including a 39% stake in Sky, to Disney for $71bn.

Fox clearly preferred the Mouse to a competing approach from US cable and broadcast combo Comcast.

But the final stages of Murdoch’s full retreat would await an end game of some complexity and not a little drama. Having failed to secure the Fox assets in the US, Comcast was intent on winning the consolation prize. Fox’s stake in Sky was pledged to Disney as part of the US deal but Comcast mounted its own spoiling bid for the rest of Sky, having tried and failed to derail the Disney-Fox tie up.

Disney and Comcast went to the wire on Sky and, when the dust settled, Comcast emerged the (somewhat impoverished) winner. It stumped up a stonking £30bn for a company that had been trading at around £20bn before the bidding war erupted.

Some wondered whether Disney might, in the end, seek to disrupt the Comcast party, by sticking with its minority stake in Sky. Doubts were dispelled a few days after Comcast’s winning bid was unveiled, when Disney sold its entire stake on the Comcast terms.

The result of one of the most closely fought battles in recent media-sector history is now clear: Disney gets the Fox movie studio and pay-TV channels, Fox’s 30% stake in Hulu (about which more in a moment) and control of Asian pay-TV platform Star.

“New” Fox (to which Murdoch snr and son Lachlan will now turn their full attention) keeps Fox News, the local Fox broadcast channels and its local sports channels. The Murdochs, through News Corporation, also continue to hold the family press interests and significant UK radio operations, including TalkSport and Virgin Radio.

Comcast, for its part, gets all of Sky, which operates pay-TV platforms in the UK, Ireland, Germany, Austria and Italy, as well as Now TV, Sky’s over-the-top alternative to “full-fat” pay-TV, and its streaming service in Spain, launched in September 2017.

Comcast is a major content distributor of Disney product in the US

Ironically, the fates of Disney and Comcast remain closely intertwined – at least for now. Comcast is a major content distributor of Disney product in the US, and Sky plays a similarly important role for Disney in Europe.

The impetus behind Comcast’s bid, and the reason it was willing to pay such an extraordinary price, is the transformative change afoot in international media and communications.

On-demand video continues to make strides at the expense of broadcast, as consumers increasingly require access to content on their own terms, not on the gift of schedulers. Meanwhile, traditional “full-fat” pay-TV is giving way to “skinny”, cheaper bundles of pay services. Netflix, Amazon and the other insurgents are forcing the pace.

Comcast is a major cable TV operator in its home market, and owner of NBCUniversal, operator of one of four national TV networks in the US and a major Hollywood studio in its own right. Despite its international pay-TV channels, international news service CNBC and UK production companies (including Downton Abbey maker Carnival), Comcast has been overwhelmingly focused on its US domestic operations to date.

At home, its growth prospects were constrained because it was already so big in traditional markets. Securing an international foothold of the size implied by ownership of Sky was an attractive short cut to diversification, critical mass and global reach.

As a major pay-TV player, Comcast understands this market profoundly

As it was already a major pay-TV player, Comcast understands this market profoundly. It was also attracted by Sky’s IP strategy – effectively, a hedge on the internet as the means of delivering video as the role of broadcast diminishes.

At home, it may regret ending up with only a minority stake in Hulu, the on-demand TV service that will be owned 60% by Disney once it completes its acquisition of Fox (adding Fox’s 30% stake to its own). AT&T, through its recently acquired Time Warner subsidiary, holds the remaining 10%.

Hulu has been an important part of the strategy of Disney, Comcast, Fox and Time Warner in the face of intense competition from new entrants such as Amazon and Netflix. Already, the main US free-to-air networks (Disney’s ABC, Comcast’s NBC, Fox’s eponymous network and CBS) have bulked up by buying or launching pay-TV variants. In nearly every case, these networks are now owned by companies that operate studios as well.

Mainstream media’s joint response to the digital new entrants, Hulu, offers both an ad-funded and a subscription video-on-demand (SVoD) variant, and it is clearly pitching for the same market as Netflix and Amazon.

Comcast may find it awkward to remain strategically invested in a proposition controlled by a principal competitor, Disney – especially when the latter is so obviously gearing up for battle in the SVoD space.

Disney has floated plans to have up to three SVoD propositions of its own in the US. The first one would be centred on a repositioned Hulu; the second would offer Disney’s premium movie and TV content (the company having already signalled the removal of most of its attractive content from Netflix in the coming year); the third would be an ESPN+ service. There has been speculation that these could be bundled at an attractive price.

Comcast may turn its direct-to-consumer attention to Now TV and the European market. The Sky-owned brand is third in UK SVoD, with fewer than 2 million subscribing households, well behind Netflix (with more than 9 million) and Amazon Prime Video (around 5 million).

Now TV has been carefully positioned in the UK and elsewhere in the Sky footprint so as not to unduly accelerate declines in the company’s core, high-revenue, pay-TV business. The theory has been that, if households really do want to quit full-fat pay-TV, then Sky can nudge them toward the skinny bundle of Now TV. If someone is going to eat your lunch, it may as well be you. The same lesson is being applied, it seems, in the case of Hulu in the US.

Now TV was one of several big attractions for Comcast

Now TV was one of several big attractions for Comcast, alongside the sheer size of the pay-TV satellite footprint, particularly in the UK, Germany and Italy. Comcast was also impressed by Sky’s advanced set-top box functionality under its new Sky Q brand and excellent customer management (better, by all accounts, than Comcast’s own service, which is much-maligned on social media).

Comcast will also be able to merge its content production and distribution assets in Europe (under NBCU) with those of Sky (under its Vision subsidiary), and take full advantage of its ownership of pay-TV platforms on both sides of the Atlantic and its control of a major film studio. Given the lack of overlap between Comcast and Sky, other than in production and distribution, this is where job cuts could materialise.

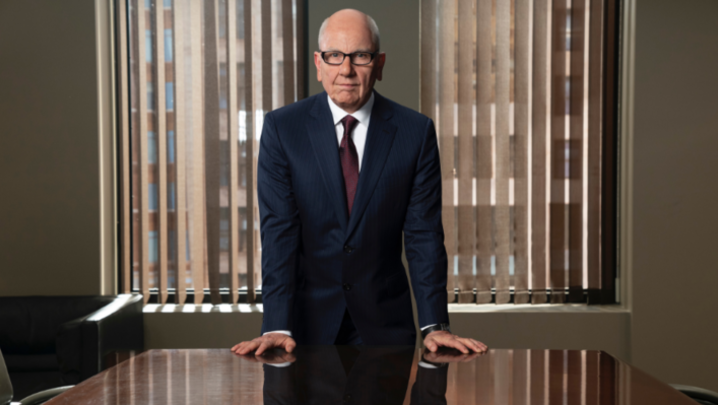

Finally, Comcast appears to be keeping on board one of the UK’s very best senior management teams, led by Jeremy Darroch.

There will be many companies watching Comcast-Sky with keen interest. Disney, for a start, will need to consider how closely it remains linked to Sky as a distribution partner, or whether it should plough its own direct-to-consumer furrow in Europe.

Among the UK public service broadcasters, ITV and Channel 4 are both looking to upgrade and evolve their on-demand propositions, either with or without the BBC.

They will also want to see how their plans might involve Sky and other pay-TV operators who share an interest in promoting UK broadcast and on-demand services in response to the challenge posed by Netflix and Amazon. Sky and the commercial PSBs are newly aligned in a market where once they were at daggers drawn.

It wasn’t cheap. But Comcast has bought itself a stellar asset. And now, abroad as well as at home, Comcast aims to use its expensively won critical mass and operational scale to strike hard and deep at the digital warriors massing at the gates.