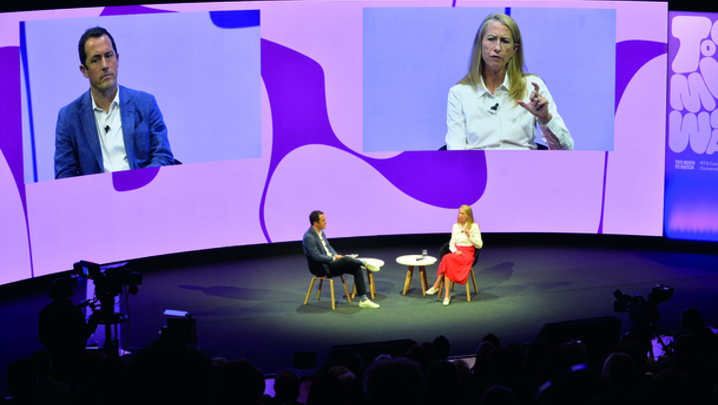

Sky’s new CEO, Dana Strong, is a dynamic former engineer who knows how to stand out in a room, says Kate Bulkley

It is just over two years since Comcast bought Sky for a massive £30.6bn, but it is only now that the company has appointed one of its own senior executives to run the European pay-TV giant. Last month, the dynamic Dana Strong, head of Comcast Cable’s consumer services business, was announced as the successor to Jeremy Darroch, who led Sky for 13 years and was chief financial officer before that.

Strong’s appointment represents the end of an era for Sky and comes as the TV business is being challenged by the rise of direct-to-consumer streaming services led by Netflix, Amazon and Disney.

While Sky’s brand and business remain strong, the impact of the pandemic, as live sports were cancelled and advertising fell, led to a 22.5% drop in earnings for the nine months to 30 September. Some observers argue that a pivot is needed to ensure Sky’s future growth and market relevance.

For the past three years, Strong has been running Comcast’s consumer cable business in the US. There, she launched several new products and reset the strategy of the consumer cable unit to focus on changing consumer needs.

Strong, who has two teenage children and a husband who is an art history PhD student at Columbia, rebranded the Comcast broadband product to Xfinity and added wi-fi boosters and parental controls as part of the package.

“Dana knew that focusing on just speed and price wasn’t going to move the needle,” says a US colleague.

Strong’s ability to lean into product segmentation comes from both her pedigree as an engineer and her 20 years’ experience of working outside the US, in both Australia and Europe; she was COO for Virgin Media, and chief transformation officer at Liberty Global as well as CEO of Liberty’s Irish cable TV operator, UPC Ireland.

“She really knows how to navigate the upper echelons of corporate environments very effectively and how to bring out the best in people who work for her,” observed Claire Enders, who runs Enders Analysis. “That inspires both great loyalty in them and good results for the company.”

Although a native of the US – Strong was born in Ohio – most of her career has been spent outside of the US. She met her husband, Mark, when they were both studying in Philadelphia. A colleague notes that Strong jokes that she first left the US so long ago that Bill Clinton was still President.

Strong will report directly to Comcast CEO Brian Roberts, who poached her from Virgin Media in 2018 following reports that she was a rising star. A recruitment dinner in Philadelphia followed, when they discussed Comcast’s family-oriented culture and she decided to accept his job offer.

Three years later, Roberts recognises there are big changes afoot in the cable business and figures that Strong has the right credentials to tackle them.

Even so, Craig Moffett of media analyst MoffettNathanson believes that the business case for Comcast’s decision to buy Sky is still unclear. He argues that a more “platform-agnostic business model” is required to counteract the trends of cord cutting and companies prioritising their own direct-to-consumer distribution over third-party players such as Sky and Comcast.

However, others might counter that Sky is already “platform-agnostic”, because it owns NowTV, one of the UK’s biggest direct-to-consumer broadband services.

To bolster its distribution business, Sky has already committed to doubling its content spend, reaching £1bn a year by 2024. In June 2019, the company also unveiled Sky Studios, a pan-European production arm that will create new shows for Sky channels, Universal Pictures and NBC broadcast and cable, as well as for third parties. Meanwhile, Sky Elstree Studios is set to open in 2022, creating up to 1,500 jobs.

Sky has agreed deals to offer Netflix, Disney+, Discovery+ and Amazon’s Prime Video on its platform, but creating original content is clearly a big part of the plan. The focus will be on drama and comedy following the success of the multi-award-winning Chernobyl, Gomorrah from Sky Italy and Babylon Berlin from Sky Deutschland.

The content side of the business will arguably be the steepest learning curve for Strong. Some observers have expressed concerns that, under Strong, Comcast could scale back Sky’s investment in content or integrate it more with NBCUniversal.

“Dana is going to have quite a few big questions to answer, with the biggest probably being deciding what the growth plan is,” said a TV executive who has worked with her. “Sky is a different business to what she has run before. She understands the retail side well, but she has never done the content side.”

While the UK business is far and away the most profitable part of Sky, there are potentially bigger growth opportunities in the German and Italian markets. In Italy, a big push on broadband and mobile products has already begun, while, in early 2020, Sky Deutschland appointed its new CEO, Devesh Raj. Before joining Sky he was a senior vice-president for strategic and financial planning at Comcast NBCUniversal in the US.

Raj and the CEO of Sky Italy have both reported to the head of Sky’s UK business, Stephen van Rooyen, for the past year, an indication that, under former CEO Darroch, there had been a move to centralise Sky. It seems likely that Strong will continue to bed this in.

Having worked in Comcast’s Philadelphia HQ for the past three years, Strong should be able to drive still more co-ordination between Comcast and Sky, for example in R&D and product innovation.

Sky has built its brand on pioneering technology and product innovation. Coupling that with the scale and ambition of Comcast will allow Sky to “double down on innovation”, says a Sky observer.

Clearly, there are some challenges ahead. Finding a growth plan in Germany may mean thinking beyond pay-TV. In the UK, it may be about identifying new products, such as home security or new mobile services – initiatives that will help “sweat” the subscriber base harder as well helping Sky reach new customers.

Growth could also be achieved through acquisitions or expanding the geographic footprint, which might be easier to persuade Comcast to fund, given Strong’s credibility with Roberts and the HQ team in Philadelphia.

Enders believes that Strong is joining Sky at an opportune moment. She says that Sky is noted for its “disciplined” approach to what it is willing to pay for live sports rights – particularly the English Premier League. With most other key content rights secure until 2026, working out the long-term telecoms strategy of Sky will be Strong’s biggest challenge.

“There is a transition to the fibre universe that is coming by the end of the decade, and positioning for that will be a strategic challenge,” says Enders.

The growth plan and the rationale for Comcast to pay as much as it did for Sky may still elude media analyst Moffett, but he concedes that “sharing managerial talent can be one source of synergy, and Dana Strong is an exceptionally talented leader with rare experience in both the US and Europe”.

Strong also has flair, a characteristic noted by Enders, who booked her to speak at the annual Deloitte Enders conference when she was still working at Virgin Media. “She has an articulateness and a freshness in her approach that is compelling,” says Enders. “I also remember the trouser suit she wore which was in that bright Virgin Media red. It was so Avengers, so cool.”