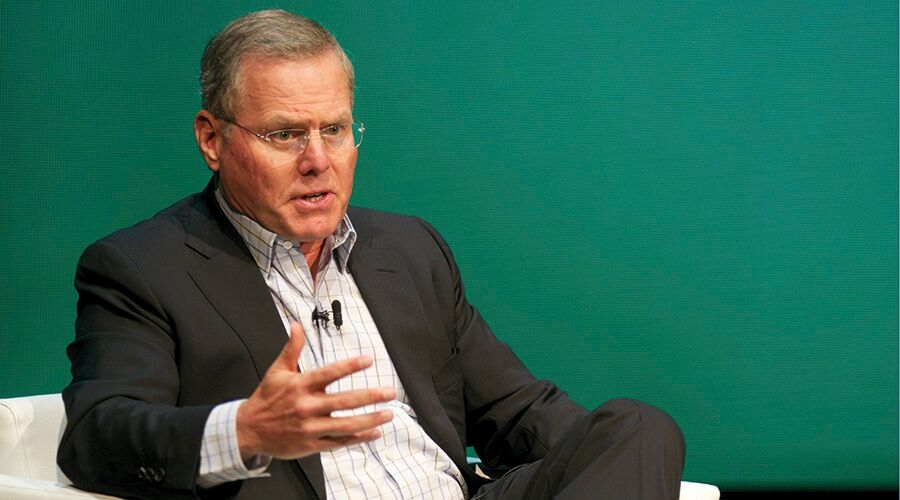

Cambridge Convention 2015 Session Seven: David Zaslav explained to the RTS how he turned Discovery Communications into a truly international giant.

Since taking command at Discovery Communications in 2007, David Zaslav has conquered the world. The US giant now operates in 230 countries – and is still expanding.

Eurosport was added to its roster of channels in 2014 and the rights to the Olympics Games nabbed this summer.

“We are a global company and more global than any other media company in the world. We have more employees outside the US than we do in the US. We make more money outside the US,” said Zaslav.

At Cambridge, he was interviewed by Sir Howard Stringer, the former Sony chief and current BBC Executive Board member. Tellingly, he described Zaslav as “enlightening and fearsome all at the same time”.

Zaslav said that Discovery’s European campaign, which he indicated was an attempt to “take Europe by storm”, was backed by an investment of $5bn.

This had led to growth of 15% a year for the past five years. “As [Europe] went into recession, most companies were taking dollars out, and local content companies and broadcasters were spending less,” he said.

Discovery’s Latin American and US markets, he added, have also enjoyed sustained growth over the same period.

Stringer informed Zaslav about the “murmuring, polite as always, about [increasing] American ownership” of UK TV companies at the Convention.

Zaslav replied: “We view ourselves as a UK company [in the UK]. We have true local infrastructure, with local people running the businesses. We’ve been here for 25 years.”

In August, recalled Stringer, media companies, including Disney and Viacom, saw their share prices plunge. What message, he asked, did Zaslav take from this financial turbulence?

We see the world the same [as 21st Century Fox]… It has a lot of ambition internationally and it is patient, like we are

The Discovery Communications President and CEO argued that the market was unconvinced that old media companies were adapting sufficiently quickly to embrace digital innovation.

“The world is changing, [albeit] very slowly,” said Zaslav. “People are consuming content on different devices and they’re consuming different types of content – in the old world, we only cared about content and how it fitted on our free-to-air cable channels.”

Discovery became the majority shareholder of Eurosport in 2014 and the sole owner this summer. In June, it paid £920m for exclusive European rights to the Olympics from 2018 (2022 in the UK and France, where deals had already been signed for the 2018 winter games in PyeongChang and the 2020 summer games in Tokyo).

Both deals, said Zaslav, were, in part, responses to the evolving media landscape. “Sport opens up opportunities to put content, not just on free-to-air and cable screens, but to super fans of sports on every device, everywhere,” he explained.

Zaslav argued that Eurosport and the Olympics were a good fit: “For us, the Olympics aren’t every other year for three weeks – 40% to 50% of what’s on Eurosport is Olympic sports, so you can follow the sports throughout the year; we can build the personalities and take [the viewer] right through to the gold medal.”

In the UK, the BBC has covered every Olympics since the early days of TV. “You’re going to have to find ways to satisfy a British audience,” pointed out Stringer. “Are you going to brand it Discovery? Are you going to license chunks of it? Are you going to give us the 50km walk and hope we’re happy?”

“We intend not only to fully comply but to over-deliver on the free-to-air commitment [for] each country,” responded Zaslav.

“In some markets, we will sell the Olympics in order to meet the free-to-air requirements, but, in those cases, we’ll probably partner up. In some cases, we’ll take it all ourselves and put it on our free-to-air or cable channel.”

Zaslav identified the Murdochs – Rupert, James and Lachlan – as his main media rivals: “I think we see the world the same [and take] a fully global approach. I spend more than half my time outside the US,” he said, “and when I look to my right I often see 21st Century Fox. It has a lot of ambition internationally and it is patient, like we are.

“There is a group of media companies saying, ‘I’ll make short-term numbers, I’ll cut where I need to, and I’ll make it work and we’ll get through this storm.’ Our strategy is: let’s invest more; we’ll make less but [we] will be

a stronger, more compelling company, with better IP, that people are watching on more platforms three to five years from now.”

Stringer asked Zaslav whether he was “anxious or excited” about the new kids on the block – Netflix, Amazon and Apple TV. “All these things are great,” replied Zaslav, “but the thing we’ve got to remember, and I don’t mean to be pejorative, but, to overstate the case: [they’re] just devices. It’s our content that makes [them] come alive.

“Content needs to be curated,” said Zaslav, who dismissed the fashion for offering customers thousands of titles as, in effect, “zero” choice. “We, as an industry, have to brand the content and the shows, and have our viewers tell us what’s the best content – and I think the best platform for that is still basically free-to-air television because that [ensures] the survival of the fittest content.”

David Zaslav, President and CEO of Discovery Communications, was interviewed by Sir Howard Stringer. The session was produced by Nicholas Jacobs and Clare Sillery.

Question & answer

Q Toby Syfret, Head of TV research at Enders Analysis: Is your vision of the way that sport will work for Discovery one that… doesn’t get into the extremes of premium content?

A David Zaslav: At least for now, our view is that we can have a hell of a business with Eurosport and not play that extreme bidding game for… football here in the UK or throughout Europe.

Now, that does not mean that – selectively – we might not opportunistically pick it up but…. in a lot of markets, where all the dollars have gone to football, the cost of the other sports… [has] only gone up very modestly.… Our mission is everything but football.

Q Kate Bulkley, journalist: You came in to bid for Channel 5 – do you regret that you didn’t get it? Would you be interested in looking at another UK broadcaster, perhaps ITV?

A David Zaslav: We don’t comment on what we bid on, but if media assets become available – and our number-one priority is international expansion, Latin America and Europe being front and centre – then we [will] look at them….

For us, right now, we think we can have double-digit, sustainable growth internationally with the hand we have.

The question[s] for us [would be]: does this help us strategically; is this important content for the future; and can we grow faster?… We expect to be deploying more capital for acquisitions in the years ahead and if there was a channel available here in the UK… we would probably look.

Q Lorraine Heggessey, Chair, Grierson Trust: You recently started acquiring content companies, having always primarily been a platform operator. What’s the strategic significance of that and are you intending to acquire more content production?

A David Zaslav: The one area that we haven’t had a lot of experience with… is scripted… So the idea of buying All3Media was quite appealing – we did it with Liberty Global, so we own it 50:50… and we bought Sam Mendes’s company [Neal Street Productions] recently.

So the idea [is to] own some additional content… [and have] access to what I would call an “IP farm” and an ability to have scripted grow under some experienced leadership that really understands [how] to develop it.