As consumers’ budgets are squeezed and their habits change, which business models can still deliver growth?

Broadcasters no longer battle just each other in the bid for growth. With expanding options in leisure and home entertainment, and consumers reeling from the cost of living crisis, the competition has broadened. Now, it includes other leisure pursuits as much as traditional rivals.

This battle for consumer attention was the focus of the second convention session, “Follow the eyeballs, follow the money: winning in the attention economy”.

A panel of industry leaders – Jan Koeppen, The Walt Disney Company; Maria Kyriacou, Paramount International; Ben McOwen Wilson, Google Play; and Stephen van Rooyen, Sky – joined conference chair Priya Dogra, Warner Bros. Discovery, to help the audience get a handle on the perils and possibilities in this new arena.

Dogra identified four aspects that needed addressing: the cost of living crisis; the opportunities provided by ad-supported services; changing consumer behaviour; and the rise of other entertainment platforms.

Cutting the cord on luxuries

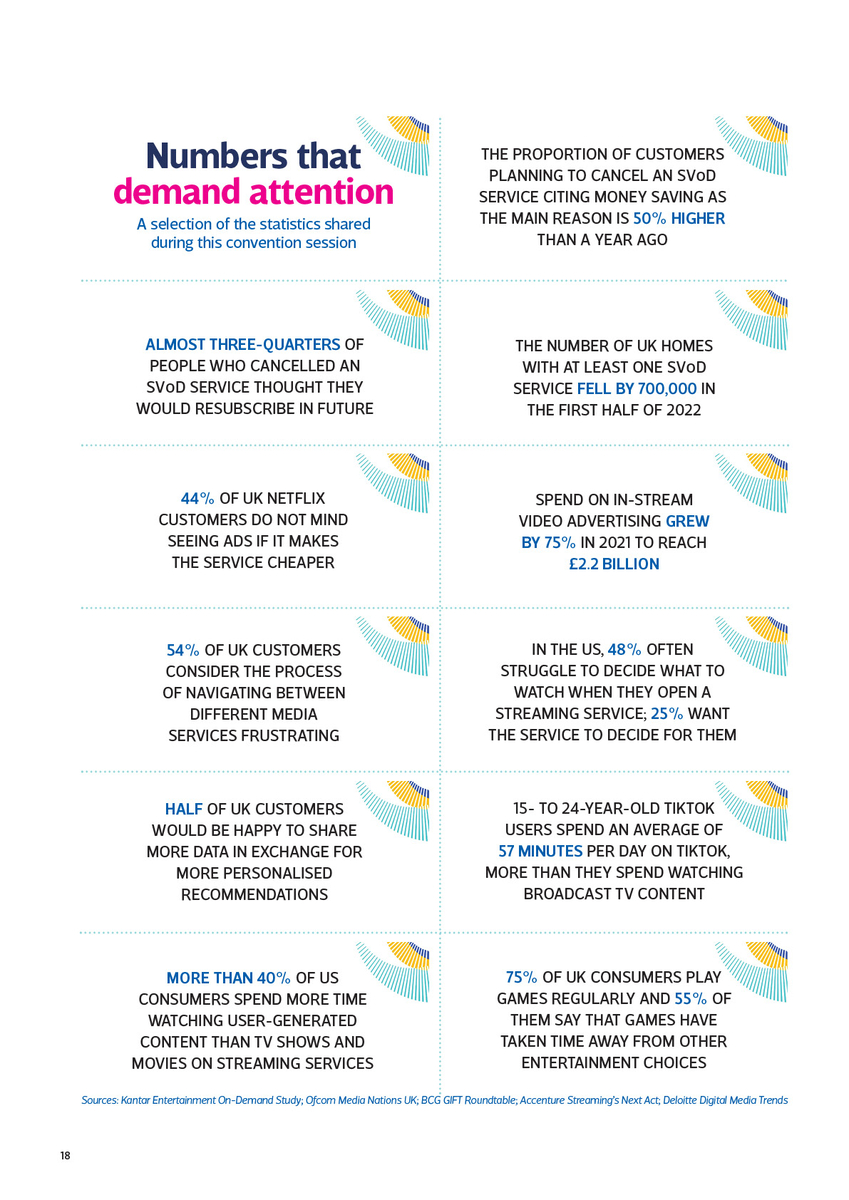

As the UK enters a recession, “give up avocados and subscription services” is the financial advice most often doled out. It seems to be having an effect – stats from the Kantar Entertainment On-Demand panel in July showed that the number of UK homes with at least one SVoD service fell by 700,000 in the first half of 2022. They also revealed that, of those respondents planning to cancel an SVoD service, there was a 50% rise in those citing money as the main reason, compared with a year earlier.

For Kyriacou, who recently launched Paramount+, the picture was more positive. In the wider market, she said, “we are launching into a growth segment as far as we’re concerned. All predictions have SVoD’s share of viewing increasing dramatically over the next few years. Launching into this market segment is absolutely the right thing for us to do, but we’re not complacent.

"Everyone who has predicted the end of broadcast TV will continue to be wrong"

Maria Kyriacou

“We have to compete on the quality of our content,” she said, citing Top Gun: Maverick, Star Trek and Yellowstone among the service’s successes. “We’re complementing all of it with something slightly unique to us: the grounding that Channel 5 gives us in the UK industry. We’re using that connection to local creative markets to make sure that we have quite a sizeable slate of UK originals coming up. We’ve already announced 20.”

Paramount’s partnership with Sky, meanwhile, “meant that we had a ready audience from day one for our content, and that gives us a lot of confidence because we can see how they react.”

Van Rooyen felt that tightening purse strings meant consumers would be “more choiceful” about their spend, especially given the flexibility allowed in the current business model of SVoDs. “Whether we like to talk about it or not, allowing people to dip in and out whenever they want is going to feed on this idea that people can trade in and trade out. Which creates a whole other set of problems for those who run the services.”

He added that Sky’s strategy was to bundle Paramount+ with Sky Cinema – “the most broadly distributed cinema service, certainly in this country, but probably anywhere” – in order to bring added value.

Koeppen, whose streaming service, Disney+, is one of the more mature SVoDs, also agreed that “powerful content” ensured a space for the service. He argued that “when the powerful content is there, as Gerhard Zeiler [of Warner Bros. Discovery] said in the first session, people come to you. That’s borne out with the numbers.”

That didn’t necessarily mean local independent productions companies would be squeezed out – “Local stories pop”, said Van Rooyen, echoing another of Zeiler’s points. “I don’t think it’s a zero-sum game. I think it’s important that you have both House of the Dragon and This England, our story about Boris Johnson. The more you look at the data, the more you will identify that you need to invest in local productions.”

Koeppen noted: “We are seeing super-high-quality local content being produced on a budget that would have been unthinkable if you went back 10 or 15 years. It rivals Hollywood production standards.”

Overall, continued Koeppen, the direction of travel – “especially in the environment that might be coming our way” – was to offer more choice, which was why Disney, among others, was adding an ad tier to its service, starting in the US. “I think it’ll be great for consumers. They don’t all want the same thing.” Which brought the panel neatly to Dogra’s next topic.

"It’s not content, it’s not distribution, it’s the viewer who is king"

Ben McOwen Wilson

The rise of ad-supported VoD

Netflix, Amazon Prime and ITV, as well as Disney, have announced the addition of ad-supported tiers to their services.

With YouTube long in the game of ad-supported streaming, Google’s McOwen Wilson was clear on how this was likely to play out: “People need to work out exactly where the sustainable business model is for each of them – and they’re each going to land in slightly different places.

“From our perspective, it’s not only about offering ad-supported services, it’s also been about innovating around formats that work on different services. If someone’s watching on a tablet versus a mobile phone versus a TV screen, it won’t be the case that the ad formats or the ad load you see in three to five years’ time are going to be identical across those services. Consumers won’t bear it.

“If the stats of churn between services tells us anything, it is that, ultimately, the viewer is king. It’s not content, it’s not distribution, it’s the viewer who is king. The businesses [represented on this stage] that appear to respond best to that will be in slots one, two and three.”

This trend towards AVoD is likely to increase competition for advertising, while also benefiting the advertising industry as a whole. “For the advertisers, it’s probably a good thing to have more places to spend their money,” said Van Rooyen, noting that Sky was itself a large advertiser. “For [consumers] willing to bear the load of advertising, it’s a good thing because it gives them cheaper access tiers than they hitherto had.”

The impact on linear channels remains to be seen, but Kyriacou, whose company also owns Channel 5, insisted that linear-TV was still attractive to advertisers: “Everyone who has predicted the end of broadcast television has been very wrong, and will continue to be wrong. Broadcast TV is still the vast majority of viewing in this country. And of that [viewing], I think the Ofcom report said, 77% is live. It should never be underestimated. That is still the preference of the majority.

“At the same time, you have to adapt your business to where the growth is, and the growth is in AVoD. We’ve seen it for [streamers] My5 and Pluto – My5 has had three consecutive years now of double-digit growth. It’s still a smaller segment for us, but it’s growing faster.”

Koeppen pointed to Hulu in the US as an example of a successful, multi-billion-dollar, ad-supported service. “People pay slightly higher prices if they don’t want to have ads, and pay a lower price if they want to have ads. It’s been incredibly successful. And, by the way, it hasn’t ruined the broadcast advertising business. It’s incredibly resilient, and Hulu has proved that they can co-exist.”

Changing consumer behaviour

As the SVoD landscape has evolved, some consumers have modified their expectations. In January, Accenture’s Streaming’s Next Act report confirmed that 54% of UK consumers found it frustrating trying to move between streaming services.

“It’s a terrible experience,” agreed Van Rooyen. “None of us should sugar-coat it. Big, lumbering, giant companies all doing their own thing have left the consumer experience by the roadside.”

Sky’s answer, he continued, lay in “seamless aggregation” with Sky Q, Sky Glass and now Sky Stream, “which we are announcing the launch of today. It is the evolution of the Sky Glass platform from the TV to a puck. It fits in the palm of your hand and plugs into your TV.

“We think that the algorithms and user interface that we have created, and the ability to move more seamlessly between apps, gives customers the right answer in a world of abundant choice.”

McOwen Wilson suggested later: “The quicker you do that, the more you reduce the [friction] for a consumer, the more likely it is that you’re not going to be one of the services that gets churned off. Even if you don’t think they have other choices in the world of television, their experiences on the internet are shaping their expectations of what a service or a screen needs to do for them.”

Koeppen argued that this was an age-old problem that was more about expectation than increased choice. “Bruce Springsteen sang 57 Channels (and Nothin’ On) 30 years ago. There’s lot of content and people have been complaining, and continue to complain. People are actually good at finding content, yet they want it to be better.

“We’re all advancing towards Stephen in one way – we obviously co-operate with Stephen on [aggregation]. Individual platforms, such as Google, certainly, and ours, and our competitors’ make it ever easier to serve up the right content.”

Arguably, a cyclical effect of the explosion of content choice is some consumers wanting a “lean-back” experience, where channels curate shows for them, even in the digital space.

“That’s where Pluto has found tremendous success in the US, and is building it here,” said Kyriacou. “It’s based on the comfort of pre-existing shows and brands you already know. You don’t have to search – you can have one show or one channel playing one thing after another.

“One thing we’ve noticed is that the number of hours a user spends on Pluto is shocking… once you’re there and you have found out how easy it is, you stay.”

"You need to invest in local productions"

Stephen van Rooyen

Rival entertainment platforms

In a world where consumers, especially younger ones, are spending so much of their time on social media and games, TV faces a tough battle for their attention. The Deloitte Digital Media Trends Survey 2022, published in April, reported that 75% of UK consumers play games regularly, and 55% of them say that games have taken them away from other entertainment choices.

So what were the panellists doing to engage those consumers spending time on the new platforms? “We’ve got about 6.5 million subscribers to our YouTube channels, and Nickelodeon has between 3 million and 4 million followers on TikTok,” said Kyriacou. “[But] the monetisation inherently happens somewhere else, so bringing them back in is absolutely critical.”

Sky and Disney also deliver content on YouTube, pointed out McOwen Wilson, because keeping content exclusive to one platform is no longer the draw it once was. He said that kids’ channel Cocomelon, for example, had started on YouTube and was now also on BBC iPlayer, Netflix, and Amazon Prime. “Historically, it wouldn’t make any sense at all. No TV licensing person in the world would have told you that this was possible. But, in 2022, this is the world we’re looking at. For those consumers, seeing Cocomelon [on it] gives that service credibility. It gives them a sense that there is content there that they can watch and they can trust.”

McOwen Wilson added there were opportunities for synergy when user-generated content covered franchises and brands relevant to broadcasters. “That’s going to be critical, especially if, as Gerhard [Zeiler] said, you are trying to create fewer, bigger franchises.”

Session Two, ‘Follow the eyeballs, follow the money: winning in the attention economy’, featured: Jan Koeppen, President, The Walt Disney Company EMEA; Maria Kyriacou, President, Australia, Canada, Israel and UK, Paramount International; Ben McOwen Wilson, MD, Google Play EMEA; and Stephen van Rooyen, EVP and CEO, UK and Europe, Sky. It was chaired by Priya Dogra, President and MD, EMEA, Warner Bros. Discovery, and produced by Robert Fraser, Graham McWilliam and Helen Scott. Report by Shilpa Ganatra.