Barb’s improved audience measurement system shows the streamers are advancing with brilliant originals but still need the support of evergreens.

Accepted TV wisdom says that traditional broadcasting’s days are numbered, and the US streamers are taking over. Up to a point, yes, but there’s still plenty of life left in television’s old guard. And no less an authority than Barb says so.

Taking the most-watched shows in May, Justin Sampson, CEO of the UK’s TV ratings body, revealed that there was not a single SVoD show in the top 20 programmes when linear viewing was included. ITV thriller DI Ray topped the list, which also included a strong showing from “social glue” programmes, such as the Eurovision Song Contest and Britain’s Got Talent.

“While the SVoD services can be very pleased with some of the viewing numbers they’re getting, they’d be much happier with the kind of numbers that are still being generated by the linear broadcasters,” said Sampson, speaking at a sold-out RTS London breakfast in July.

What’s more, he added, SVoD services “rely on a combination of new and established content” – just like traditional broadcasters.

TV needs “fireworks and bonfires”, he said, explaining: “You need to have bright shows that explode into the schedule and create audiences, while you also need to have content that people keep coming back for. This is something the broadcasters have relied on for many, many years. And guess what? The SVoD services rely on it as well.”

Just five streamer shows – The Big Bang Theory, Friends, Brooklyn Nine-Nine, The Simpsons and the US version of The Office – account for 11% of all SVoD viewing. “For the SVoD services, it’s the new stuff that gets all the headlines but, without these five series, their viewing would decline quite dramatically,” said Sampson. “[So], to what extent are SVoD services really that different from broadcast services in terms of their reliance on a combination of established and new content?”

As Sampson promised at an earlier RTS event, in April 2021, Barb is now able to publish viewing figures for SVoD and video-sharing services on the same basis as those for broadcast TV. This enables meaningful comparisons to be made for the first time.

Since November, with ratings from the likes of Netflix, Amazon and YouTube joining the linear schedules, Barb has been providing a more complete picture of the nation’s viewing habits.

It has taken Barb longer than it would have liked to start measuring SVoD viewing. The TV ratings body has attached a meter, which reads the URL information for the streaming services, to the wi-fi router at the carefully selected 5,300 homes it uses to represent all segments of UK society. “If we’d had the [streamers’] engagement and involvement, they could [have] helped us do that more quickly,” said Sampson.

He added that Barb aims to increase its viewing panel to 7,000 homes, which it should achieve by early 2024.

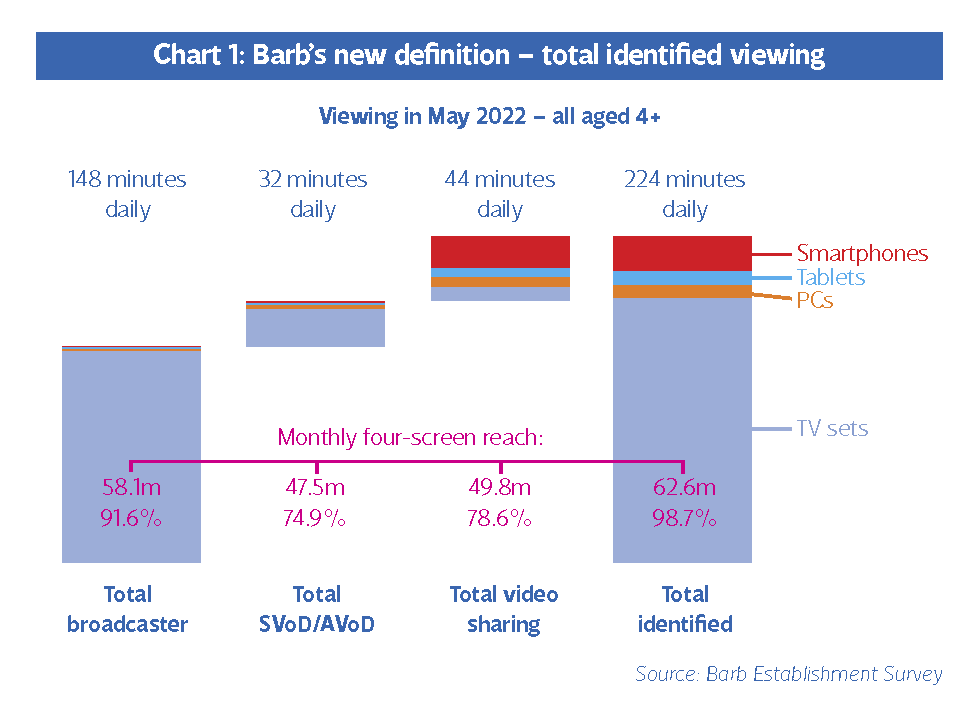

Barb is using a new definition of “total identified viewing”. This is the sum of the time spent watching linear broadcast channels and broadcaster-owned VoD services, 19 streamers (both SVoD and advertising-supported VoD) and video-sharing platforms such as TikTok and YouTube. Barb captures viewing across four screens — TV sets, tablets, PCs and smartphones – but for streaming and video-sharing services, it can only count viewers via home wi-fi networks. More on which later.

For May, total identified viewing amounted to 224 minutes a day for everyone aged four-plus, comprised of 148 minutes watching traditional broadcasters; 32 minutes for the streamers; and 44 minutes for video-sharing services (see Chart 1).

Some 98% of total broadcast viewing is on a TV set; likewise, 87% of Netflix viewing. TikTok content is at the other extreme, with 94% watched on smartphones. Perhaps surprisingly, YouTube does have a significant TV presence, at around 25%.

Any parents worried that their teenage children may be addicted to videosharing platforms should stop reading this paragraph now – “10% of YouTube viewers account for half of all its viewing,” said Sampson.

Adults, though, are guilty of bingeing, too – 45% of the 28-day audience for the Ricky Gervais Netflix show After Life watched all of the last series within four days of its release in January.

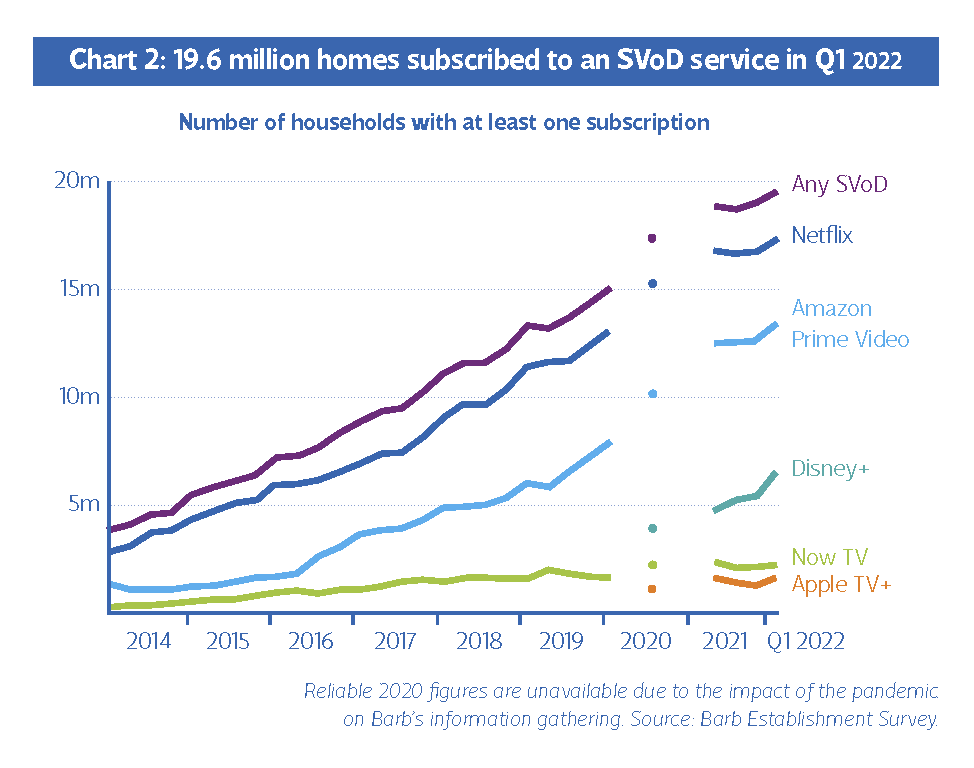

Streamers may not be pushing the linear broadcasters off the TV sofa, but they are taking up more room. According to Barb, 19.6 million homes now subscribe to a SVoD service – a little over two-thirds of the UK’s 28.5 million homes. The most popular is Netflix, followed by Amazon; the fastest growing is Disney+ (see Chart 2).

Some 13.2 million homes have at least two streaming services, about which Sampson opined: “That is on the increase… there is still evidence that people are adding SVoD subscriptions to their portfolio.” Though, as the cost-of-living crisis bites hard this winter, streamers my find they start to lose subscribers.

Much has been written about Netflix being in crisis, having suffered a fall in subscribers and share price this year. In July, Netflix recorded a second quarterly drop in subscriber growth, losing 1 million viewers in the second quarter, although this number is lower than the 2 million it had originally projected.

But Barb figures tell a different story. “The actual subscription levels are tracking well ahead of Netflix’s [UK] pre-pandemic growth levels,” said Sampson. “I believe that the story of Netflix’s subscriptions being now in decline is not the right story – I think it is still heading for subscription growth.”

There are gaps in Barb’s figures – most notably it is unable to collect viewing data on streaming and video-sharing services watched outside the home. “It would be great to have more involvement from the streamers, who are, at the moment, a bit at arm’s length,” said Sampson.

“It’s not a straightforward conversation,” he continued. “These companies are American and they are looking to do things in a way that’s consistent across all markets. While the UK is an important market, the UK, as far as the Americans are concerned, is a part of Europe and we’re a bit further ahead in terms of what we’re doing in the UK than our counterparts on continental Europe.” In fact, only the US, where Nielsen provides comparable data, has similar SVoD ratings to those provided by Barb.

Sampson concluded: “We’ve got open conversations. Are they going as quickly as I would like? No, but they’re not dead.”

Report by Matthew Bell. The RTS London event ‘Breakfast with Barb: Understanding what people watch’ was held at the Soho Hotel in central London on 7 July. It was chaired by the journalist and broadcaster Nadine Dereza, and produced by RTS London Chair Phil Barnes.