It's not only the fans who will be watching Amazon Prime's live Premier League kick-off next month, as Ross Biddiscombe discovers

A run-of-the-mill English Premier League fixture on a Tuesday evening early next month is set to be one of the most significant football matches to be played in more than two decades.

That is because the game between Crystal Palace and Bournemouth will be the first ever to be broadcast live and exclusively by one of the tech giants.

Amazon, the global digital platform and retailer, is showing this and 19 other Premier League games to UK audiences during December via its subscription service Amazon Prime after paying about £90m for a three-year deal.

After more than 25 years of Premier League live games being carved up by pay-TV platforms, Amazon’s entry into the UK football market will be studied intensely across the sporting world.

“We’re entering a new era of sports rights valuations,” says Enders Analysis research analyst Julian Aquilina. “This is the moment of truth for British football’s value, and its success or failure will be noted and reflected around the world.”

Amazon Prime's Back of the Net (credit: Amazon Prime)

Amazon’s offering will include a few innovations, such as a live “around the grounds” goals show, with action from as many as six matches happening simultaneously. The coverage, however, will feel similar to Sky and BT Sport, especially in terms of on-screen talent.

Game experts include Thierry Henry and Alex Scott, while Gaby Logan and Peter Crouch from Amazon’s own Back of the Net football entertainment show will also appear.

“On Boxing Day alone, we will have more than 50 on-screen presenters, pundits, reporters and commentators. We wanted to create a broad line-up of presenters, pundits and commentators, with a mixture of familiar faces and newer ones,” says Alex Green, Managing Director of Amazon Prime Video

in Europe.

Green is confident that Amazon’s technological infrastructure will cope with streaming multiple concurrent matches, despite concerns expressed by fans, who complained of buffering issues during live ATP men’s tennis games earlier this year on Prime.

Fans also said navigation was “clunky” on the busy Prime home page. Yet Amazon’s “test and learn” approach – like that of all software companies – means Green is convinced of the success of what he calls “one of the biggest streaming events worldwide”.

So, will football fans subscribe to yet another service? It’s been estimated by Ampere Analysis that Amazon will need at least 600,000 new or retained subscribers for each of the three years of this deal in order for it to make financial sense.

Classic Premier League fixtures, such as Liverpool vs Everton and Manchester United against Tottenham, will certainly help, says Aquilina: “But it’s also about database collection for Amazon, and the good thing is that, historically it’s done very well at retaining customers; it has a very low churn rate, particularly when customers sign up for a whole year, which is what Amazon is hoping.”

However, estimating potential Premier League income is complicated because, at the moment, Amazon is offering a free one-month trial. In other words, some core fans may choose not to buy a long-term £7.99 monthly subscription package that includes all other Prime TV shows and free delivery on any online purchases.

"Of the UK online services, Amazon is the best fit for football"

Yet the analyst community believes that the key 600,000 subs number is achievable. Ampere Analysis estimates that only 25% of current Prime subscribers like to watch Premier League games, which suggests that there are many football fans who have yet to sign up for Prime.

Richard Broughton, research director at Ampere, is betting on Amazon’s deal succeeding financially: “It’s a relatively small Premier League package and it can easily afford it. Amazon will make money not just through subscriptions but with its margins on products sold through its retail [platform]. That’s why, of the online services in the UK, Amazon is the best fit for live football.”

While Amazon experiments with football, major sports rights bidding in the UK by other digital giants is at best patchy. Facebook has broadcast a few niche sports live, such as triathlons, and it discussed a $600,000 Indian Premier League cricket deal in 2017 but it was eventually outbid.

Meanwhile, YouTube (owned by Google) has twice screened the Champions League final live thanks to a partnership with BT Sport. Netflix seems content with having a few sports documentaries.

But, whether or not Amazon succeeds or fails with its Premier League package, the whole live sports rights market is set for huge changes as the pay-TV companies hint at belt-tightening to come.

Crucially, despite the Amazon deal, the total value of the current domestic Premier League rights income fell, compared with three years ago.

The 2015 auction was worth £5.4bn (paid by Sky and BT Sport), but the current deal (which also includes Amazon’s money) is worth just over £5bn, despite more games being sold and a couple of smaller game packages being created to attract bids from a tech giant.

The other bad news for sports TV rights owners is Amazon’s low churn rate. “If [low churn] happens with football fans, then you don’t need to buy the Premier League rights again to keep that Amazon Prime customer,” says sports broadcasting consultant Phil Lines.

“You would only buy the rights again – or more rights – if you think it will add significantly more football fans than you’ve already got as a result of your initial Premier League purchase.” If this is the case, a second Amazon bid for Premier League games may be unlikely.

Other significant voices are also suggesting difficult times for sports rights. Enders Analysis boss Claire Enders has already gone on record this year predicting a 20% drop in the value of the Premier League’s domestic rights in the next auction in 2021.

Analysts believe that, if the price declines for the League, then so could the value of all other UK sports rights.

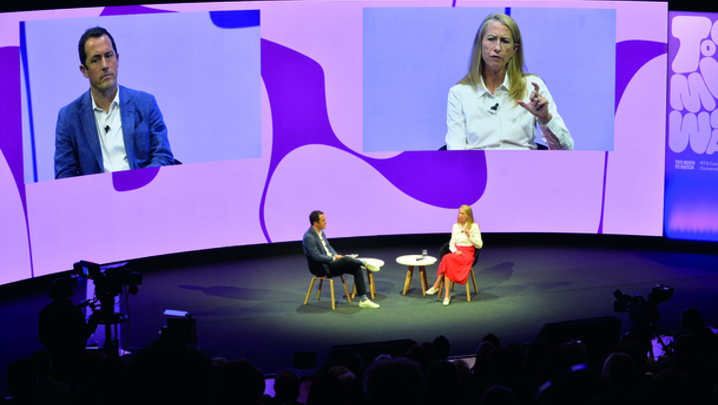

At the RTS Cambridge Convention in September, Sky CEO Jeremy Darroch said that losing some sports rights would no longer have a big impact on his business.

"The economic case for investing in drama rather than premium sports makes sense"

(credit: RTS/Richard Kendal)

Darroch said that fewer than half of Sky customers nowadays take sport, compared with 93% in 2004, when he joined the company. “At the time, we were very, very wedded to sport and I didn’t like the look of that,” he said. “We are very, very value driven. Our ability to analyse the value of sport and understand where it fits into our business… we’ll decide where that is at the right time.”

Sky Studios is emerging as a significant content producer, not least in drama, with Chernobyl expected to dominate TV awards ceremonies. The economic case for investing in drama rather than premium sports makes sense.

Yet, as a new generation of direct-to-consumer services becomes available (both Apple TV+ and BritBox launched earlier this month) only a fool would write off the appeal of live TV sports.

“In the next year or two, more studios will have moved aggressively into international markets with direct-to-customer offerings of their own and they will withhold rights to their programming to third parties such as Sky,” said Richard Broughton. “Yes, that will free up budget for pay-TV companies to make their own programmes, but it also makes remaining rights, like sports rights, more valuable.

“Perhaps, this could be a silver lining for the Premier League.”