From Discovery merging with WarnerMedia to All3Media acquiring more producers, media companies are scaling up, reports Kate Bulkley.

There is a media consolidation bonanza under way, with no let-up in sight. The boom is sucking in big legacy media companies, including Hollywood studios such as Warner Bros and MGM, as well as broadcasters, production companies and global tech platforms. With its world-class creative talent, the UK is not immune, and the rush by companies to scale up and secure access to premium content is happening worldwide.

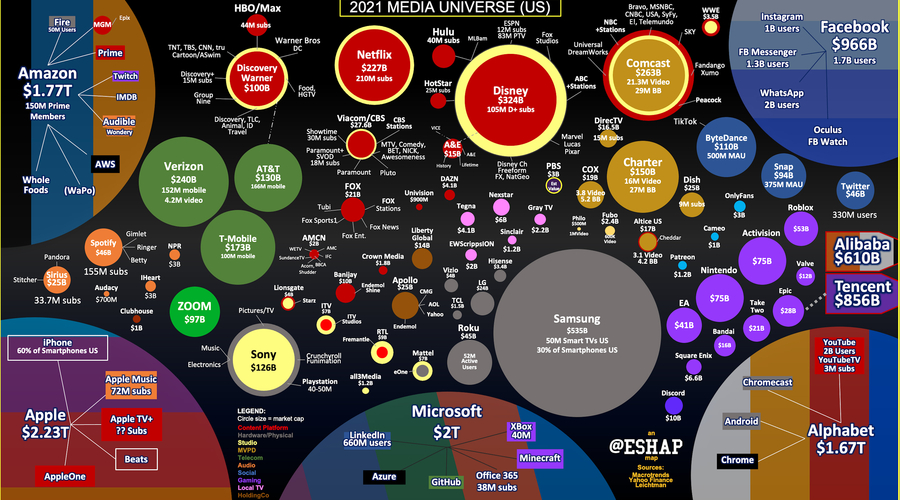

The stakes could not be higher and, in some cases, are literally existential. “When you look at the entertainment war for attention and you realise that there are seven trillion-dollar Death Stars – Amazon, Google, Facebook, Microsoft, Apple, Tencent and Alibaba – all with unlimited resources and diversified revenue models, you understand why scale is the most important thing,” says Evan Shapiro, producer, media commentator and creator of the Media Universe Map.

WarnerMedia’s merger with Discovery, announced in May, is a clear scale play. It creates the second-largest media company after Disney by revenue, with the aim of competing against Netflix, Disney+ and Amazon Prime in the streaming market.

In late May, Amazon slapped down $8.45bn to buy the MGM film and TV library, stunning many. The move secured access to a treasure trove of properties, from James Bond to Legally Blonde. “There are so many opportunities for remakes and spin-offs, with titles across 50-odd years,” says Tom Manwaring, partner at Helion, a media mergers and acquisitions specialist.

At the recent virtual Banff World Media Festival, Netflix’s chief content officer, Ted Sarandos, indicated that the streamer is looking to buy production companies. Indeed, Netflix has reportedly made offers to several. But a big stumbling block for sellers is that Netflix wants to lock in exclusive access.

“This ‘exclusive to Netflix’ clause has made potential deals fail,” says one executive familiar with the situation. “If Netflix can get an output deal and get access to content supply that way, it will do that first, for sure.”

In Europe, France’s two biggest commercial broadcasters, TF1 and RTL Group-owned M6, are planning to merge in a move that would create a player responsible for 70% of the French TV advertising market.

The proposal will certainly be the subject of a competition review in France but, in a media business increasingly dominated by global players such as Facebook and Google, traditional competition rules look increasingly irrelevant.

Weeks after the TF1-M6 announcement, RTL announced a separate deal that would see it merge its Dutch businesses with Big Brother producer John de Mol’s Talpa Networks. The deal will create a broadcasting and production group boasting a combined annual content spend of €400m and joint revenues of €909m.

"92% chance of Apple or Netflix buying Lionsgate" - Evan Shapiro

“The new cross-media group will have the size, resources and creativity to compete with global tech platforms in the Netherlands when it comes to investing in premium content, offering the most advanced addressable advertising opportunities, and expanding Videoland, the leading national streaming service for Dutch viewers,” says RTL Group CEO Thomas Rabe.

In early July, it emerged that European production giant Mediawan & Leonine Studios had taken a majority stake in UK indie Drama Republic. The French and German outfit, formed last year as a joint venture by Mediawan and Leonine, has acquired a 51% share in Drama Republic, producer of Doctor Foster, sold in more than 100 territories, and The Honourable Woman.

The shift of audiences and advertisers to streaming services has undermined commercial broadcasters’ business models. This makes them more vulnerable to being bought, which is why European broadcasters want to partner or merge to scale up their businesses.

In the UK, All3Media has also been in buying mode again. It recently completed the acquisition of Nordic Entertainment Group’s Nent Studios UK, producer of the Connie Nielsen and Christopher Eccleston drama Close to Me.

Nent Studios UK was formerly known as DRG and has 10,000 hours of content, including the licensing rights to Doc Martin and Catchphrase. All3Media CEO Jane Turton says: “There has never been more demand for high-quality IP.”

Similarly, the tech platforms are continuing to look for opportunities to secure the content they need to stand out in the increasingly competitive streaming business.

Not only that, but most of the tech players are seeking to diversify their revenue streams. Google and Facebook face tightening regulations over how they control user data and targeted advertising, the core of their current business models.

In the UK, Google, Amazon and Samsung are facing a regulatory overhaul that will guarantee the prominence of public service broadcasters (the BBC, ITV and Channels 4 and 5) on smart televisions and devices.

This rule change should strengthen the broadcasters’ power in their negotiations with platform operators and device makers in a key battleground for attracting audiences.

Clearly, a crucial driver of value and kudos for production companies these days is how many successful shows they have on the big streamers. Bristol-based natural history producer Silverback Films was purchased by All3Media in late 2020 at an enhanced value. The success of the Netflix series Our Planet, narrated by Sir David Attenborough, was a crucial factor.

Streaming success may be driving values but UK indie producers are keen to talk to potential partners or acquirers based in Europe.

Since Brexit there has been a big question mark over whether British productions will continue to be considered “European works” and thus retain access to European production funding.

A case in point is Death in Paradise producer Red Planet Pictures. It sold a majority stake to private-equity-backed Asacha Media in late June. The deal will allow the indie, chaired by showrunner and writer Tony Jordan, to access Paris-based Asacha’s network of European producers for local adaptations and co-productions. These include companies in the Middle East and eastern Europe – Jordan created the drama Besa for Serbian channel Prva and the soap Al Mirath for MBC.

The race to scale up and to secure access to premium content is far from over, and has thrown up some surprising plays. In January, Apple paid a whopping $25m for the worldwide rights to CODA, a much-anticipated remake of the award-winning 2014 French film La Famille Bélier. Speculation surrounds the iPhone maker’s acquisition strategy – might it bid for gaming company Electronic Arts or sports network DAZN?

While many media businesses envy Netflix’s high market capitalisation, it would be difficult to imagine Comcast’s CEO, Brian Roberts, AMC boss Josh Sapan or Warner Bros Discovery’s CEO, David Zaslav, embracing such a debt-heavy, loss-making business model.

Indeed, Disney is the outlier among the legacy media giants, and has taken big risks and incurred the losses needed to pivot so quickly to a streaming model.

Shapiro has ranked the probability of the next 10 big media mergers/acquisitions. The top ones are those with content assets. He rates Twilight and Mad Men producer Lionsgate as a buy for either Apple or Netflix, with a 91.7% probability.

Disney buying what it doesn’t already own of producer/broadcaster A&E Networks is given an 88.9% probability, while Shapiro predicts that Spanish-language broadcaster Univision has an 85.7% chance of being sold to either Disney, Apple or, perhaps, Google.

“The acquisition of Lionsgate by Apple makes a lot of sense because it would get Twilight and Mad Men, and the Starz streaming service has 15 million subscribers,” says Shapiro. “Apple has been in the television business for as long as Disney but has a fraction of the subscribers because it has a fraction of the content.”

Even online TV platform and device company Roku has been touted as an acquisition target. Speculation rose after the service posted an unexpected profit in the first quarter, driven by a 35% year-on-year jump in subscriptions.

Expect the deal-making season to continue for the foreseeable future.